Lowering health insurance costs starts with exploring practical options like choosing high-deductible plans paired with Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), considering alternative care models such as Direct Primary Care (DPC), and leveraging tax-advantaged accounts. These strategies reduce premiums and out-of-pocket expenses by emphasizing transparency, preventive care, and efficient healthcare delivery.

Explore Health Insurance Alternatives

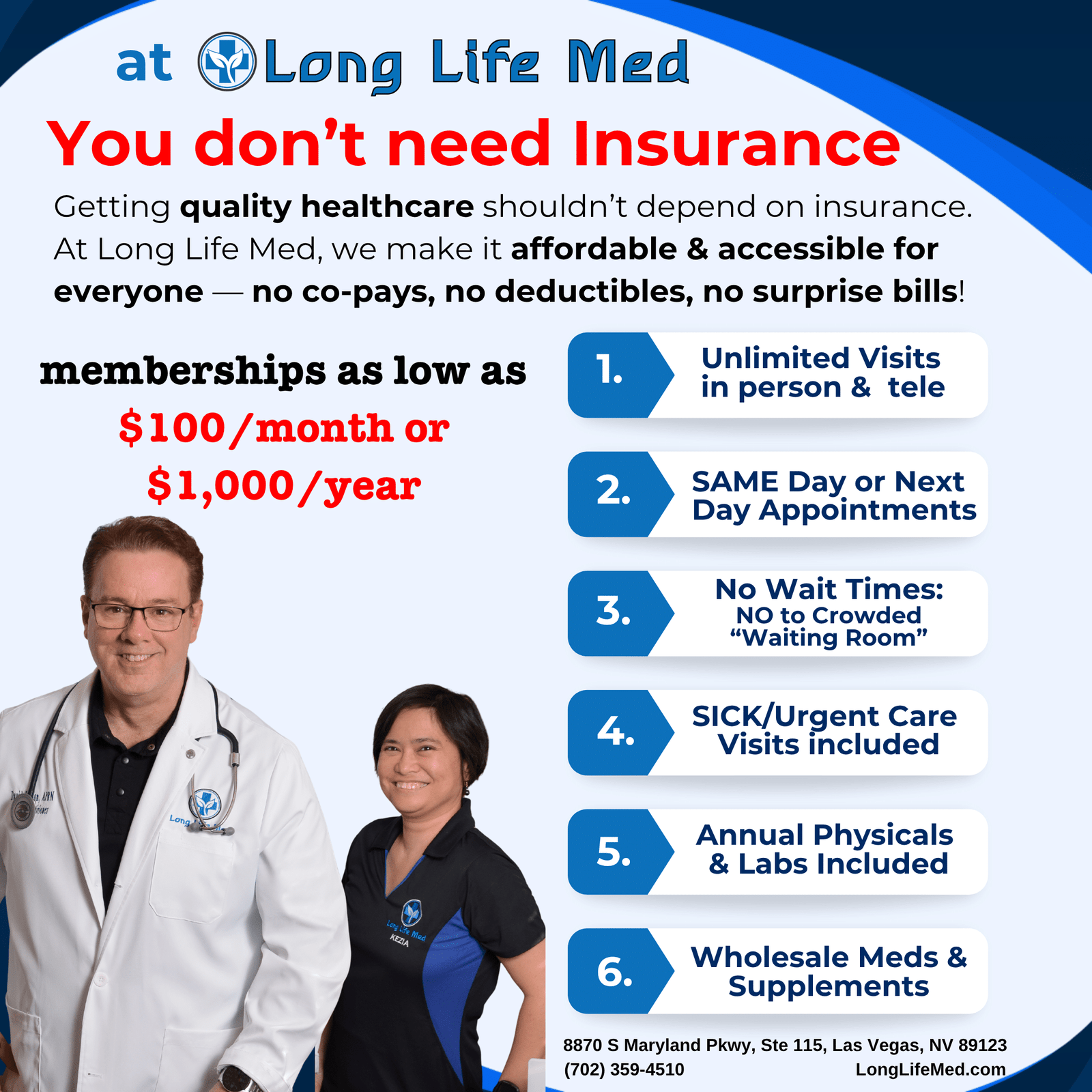

One of the most impactful ways to lower health insurance costs is by opting for health insurance alternatives such as Direct Primary Care (DPC), short-term plans, or health sharing programs. Long Life Med offers a concierge-like DPC model where patients pay a low monthly membership fee that bypasses insurance billing and passes wholesale discounts on labs, medications, and supplements directly to the patient. This significantly reduces overall healthcare spending while providing same-day or next-day access to providers, enhancing convenience and saving time.

Pair High Deductible Plans with Membership Models

Pairing a high deductible health plan (HDHP) or catastrophic insurance plan with a DPC membership can provide significant cost savings. While HDHPs offer lower monthly premiums, the DPC membership covers primary care needs affordably, preventing expensive emergency room visits. This combo also allows the use of HSAs or FSAs to cover memberships, medications, and lab costs with pre-tax dollars, reducing taxable income and maximizing savings.

Other Practical Cost-Lowering Tips

- Shop Actively During Open Enrollment: Compare plans annually to find the optimal balance between premiums, deductibles, and coverage.

- Take Advantage of Employer or Small Business Plans: Programs like Long Life Med’s small business plans can reduce expenses by up to 30%, while increasing healthcare access quality.

- Utilize Out-of-Pocket and Cash-Pay Services: For elective or preventive care, paying out of pocket can avoid inflated insurance costs.

- Invest in Preventive and Functional Medicine: Staying proactive with wellness programs can prevent costly chronic conditions and hospitalizations.

Long Life Med’s Affordable Care Approach

Long Life Med, based in Las Vegas and Henderson, offers an affordable DPC membership service that helps individuals and businesses control healthcare costs. Unlike traditional concierge models, it does not bill insurance and accepts all patients regardless of insurance status. It offers transparent pricing, text and phone access to providers, and eliminates long waiting times. Specialized services like hormone therapy, red light therapy, and peptide therapies are available with clear, separate pricing.

FAQs About How to Lower Health Insurance Costs

Q1: What is the easiest way to lower health insurance costs?

A1: Consider switching to a high deductible health plan and pairing it with a Direct Primary Care membership like Long Life Med’s. Use HSAs or FSAs to save tax-free on healthcare expenses.

Q2: Can alternative care models really save money?

A2: Yes, models like DPC reduce administrative costs, provide wholesale pricing, and eliminate surprise bills common with traditional insurance.

Q3: How often should I compare insurance plans?

A3: Annually, during open enrollment, to ensure you are getting the best coverage for your budget and healthcare needs.

Q4: Are small business plans beneficial for lowering healthcare costs?

A4: Absolutely. They can reduce employer and employee expenses by up to 30% while ensuring quality care access.

Experience Affordable, Accessible, Functional Medicine at Long Life Med

Serving neighborhoods near St. Rose Siena Hospital and Silverado Ranch, Long Life Med combines functional medicine’s root-cause approach with the convenience and savings of direct primary care. For expert functional medicine without insurance hassles, trust Long Life Med to prioritize your long-term health and well-being. Call (702) 359-4510, email hello@longlifemed.com, or visit 8870 S Maryland Pkwy, Ste 115 to start your personalized care journey today.