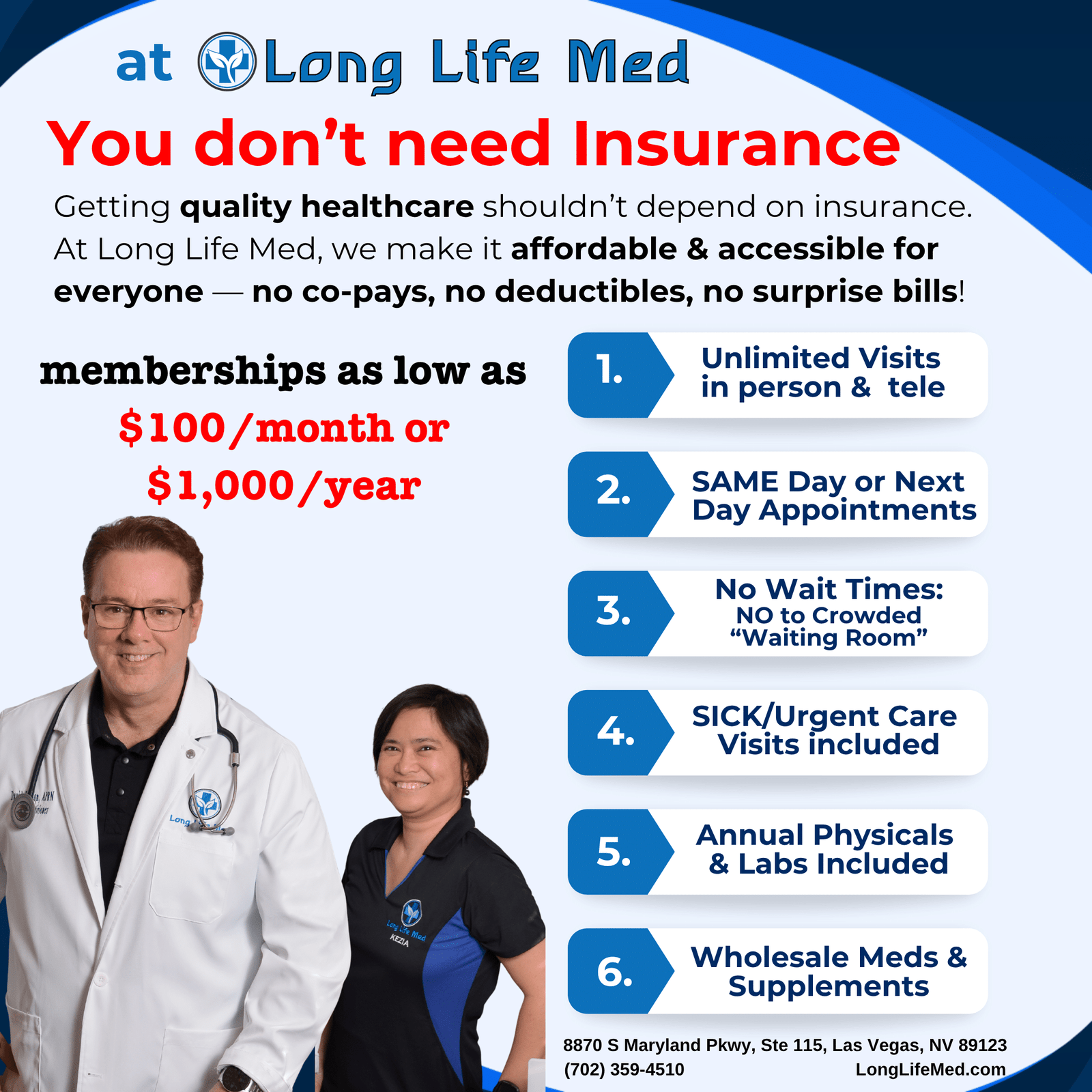

Traditional health insurance often falls short due to high costs, restrictive networks, and limited coverage for holistic and preventive therapies. Exploring health insurance alternatives like Long Life Med’s concierge-like Direct Primary Care (DPC) with urgent care, provides Las Vegas patients with personalized, functional medicine-based care that is both affordable and comprehensive.

Why Consider Alternative Healthcare Insurance?

Traditional insurance plans frequently exclude many functional and regenerative medicine services such as hormone therapy, peptide treatments, red light therapy (RLT), and orthobiologics (stem cells & exosomes). These plans often have high premiums, limited provider options, and complex claim processes. Alternative healthcare insurance focuses on root-cause approaches, tailored wellness plans, and patient-centered care that emphasize prevention and longevity.

Popular Types of Health Insurance Alternatives

Direct Primary Care (DPC)

DPC is a membership-based model providing unlimited access to your primary care provider for a flat monthly fee. Unlike concierge medicine, Long Life Med’s DPC model does not bill health insurance and accepts patients with or without insurance (including HMO and no insurance). Patients benefit from wholesale discounts on medications, supplements, imaging, and lab tests passed directly to them. DPC also allows usage of pre-tax HSAs or FSAs to pay for membership and prescribed treatments, offering significant cost savings and transparency.

Membership-Based Healthcare (Concierge Medicine)

Concierge medicine usually involves insurance billing plus an additional membership fee and requires PPO insurance. This traditional concierge care is typically more expensive and restrictive compared to DPC models.

Health Shares and Medical Cost Sharing

Community-based sharing programs pool member contributions to pay for medical expenses, often including alternative therapies. Though less regulated than insurance, these can provide flexible coverage options.

FSAs and HSAs

While not insurance, Flexible Spending Accounts and Health Savings Accounts allow patients to set aside pre-tax dollars for qualified medical expenses, including alternative therapies, further easing out-of-pocket costs.

Private Pay and Specialized Insurance Plans

Patients may also pay out-of-pocket for elective or alternative medicine services to maintain maximum control over therapies. Specialized insurance plans may exist for alternative treatments like acupuncture or chiropractic care, but are often limited.

Long Life Med: Concierge-Like Direct Primary Care with Functional Medicine Focus

Long Life Med offers a next-generation DPC and Functional Medicine clinic in Las Vegas and Henderson, merging advanced personalized care with affordability. Key benefits include:

- Direct access to providers by call or text, often resolving patient concerns without in-clinic visits, avoiding exposure to communicable illnesses.

- Same-day or next-day appointments without long waiting lines are common at local primary care providers.

- Transparent pricing and wholesale discounts on medications, labs, supplements, and imaging.

- Comprehensive functional medicine plans including hormone therapy, peptide treatments, gut health, allergies, red light therapy, and regenerative medicine options like stem cells and exosomes (some as separate, all-inclusive plans).

- Small business memberships starting at $75/month, helping employers and employees save up to 30% on healthcare while improving care utilization and reducing absenteeism.

Benefits of Choosing Health Insurance Alternatives Like Long Life Med

- Personalized, patient-focused care integrating functional and regenerative medicine

- No insurance interference; acceptance of patients with any or no insurance

- Faster appointments, avoiding stressful waiting rooms

- Transparent, affordable access to cutting-edge therapies and wellness programs

- Family and business-friendly membership models tailored to specific needs

FAQs About Health Insurance Alternatives

Q1: Are health insurance alternatives suitable for everyone?

A1: Alternatives like DPC work well for patients seeking holistic, preventive care but may have limitations for complex chronic conditions that require traditional insurance coverage.

Q2: Do health shares qualify as insurance?

A2: No, health shares are community programs that share medical costs among members but lack the regulatory protections of traditional insurance.

Q3: Can I combine traditional insurance with Long Life Med’s DPC?

A3: Yes. Long Life Med’s membership complements existing insurance, allowing the use of HSAs or FSAs and covering services not handled by insurers.

Q4: How does Long Life Med differ from concierge medicine?

A4: Long Life Med is concierge-like but more affordable, does not bill insurance, and accepts all insurance types, including HMO or no insurance, unlike traditional concierge, which requires PPO.

Experience Affordable, Accessible, Functional Medicine at Long Life Med

Serving neighborhoods near St. Rose Siena Hospital and Silverado Ranch, Long Life Med combines functional medicine’s root-cause approach with the convenience and savings of direct primary care. For expert functional medicine without insurance hassles, trust Long Life Med to prioritize your long-term health and well-being. Call (702) 359-4510, email hello@longlifemed.com, or visit 8870 S Maryland Pkwy, Ste 115 to start your personalized care journey today.